TAX INFORMATION FOR

THE BEND, OREGON AREA

First, here’s how Bend Property Taxes are calculated:

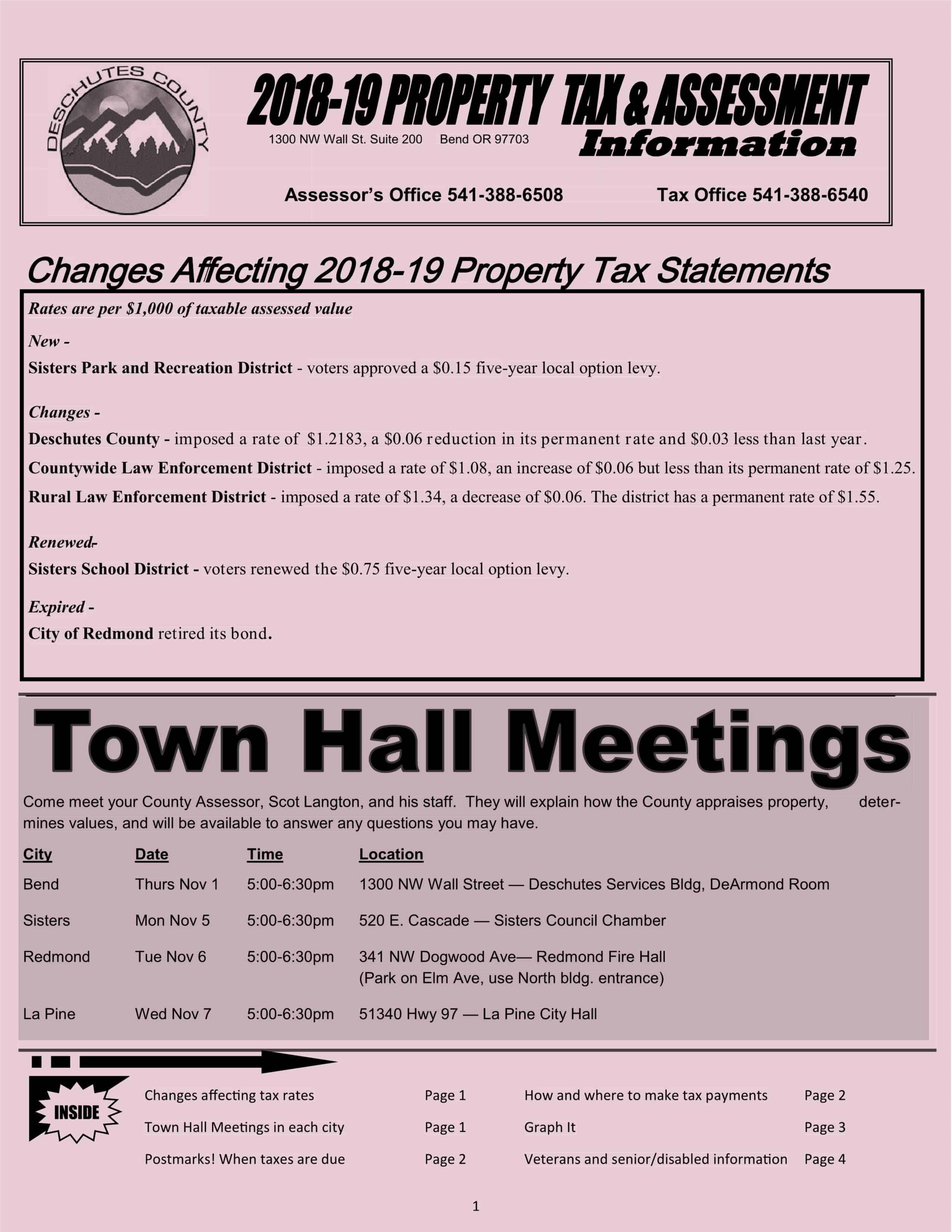

In Oregon, Bend property taxes are collected by the County and distributed to each taxing district (schools, cities, county agencies, fire districts, road districts, etc.). The amount of Bend property taxes that you pay is based on two things: 1) the assessed value of your property and 2) the tax rates and bond debt service amount your taxing districts levy.

Generally, the increase in your assessed value is limited to 3% unless changes have been made to your property due to ballot Measure 50 limitations. The Assessor compares the Real Market Value (how much your property is worth, as determined by the Assessor, as of January 1 each year) to Maximum Assessed Value (the 1995 value reduced by ten percent, plus changes that were made to your property, increased by 3% each year after 1997). The lower of these two values is your Assessed Value.

Taxes may increase by more than 3% due to voter-approved ballot measures. In addition, Bend Property taxes may also increase or decrease due to other changes, such as the amount a district needs to pay for voter-approved bond debt, or property annexations.